tax avoidance vs tax evasion south africa

Is everything in between which constitutes you paying less tax than SARS would like. Tax Avoidance vs Tax Evasion Infographic.

Measures improving the ability to enforce tax laws 26 521.

. GAAR - General Anti-Avoidance Rule IBSA - India-Brazil-South Africa IFF - Illicit Financial Flows IFRS - International Financial Reporting Standards IP - Intellectual Property. Addressing weak enforcement at the. The South African Revenue Services SARS crackdown on non-compliant taxpayers in recent months is well documented.

When considering evasion vs avoidance there are different tax reducing acts which will depend on the tax type at hand. Tax avoidance in this sphere would be importing unassembled goods which are taxed at a lower customs duty rate and then having them assembled in South Africa. In order to answer this question one needs to consider the difference between permissible tax avoidance arrangements and impermissible tax avoidance arrangements as well as the difference between tax avoidance and tax evasion.

In this article I will explain what tax avoidance. Tax Deductions PAYE on your Pension or Annuity. Tax Avoidance is legal.

Tax avoidance is generally the legal exploitation of the tax regime to ones own advantage to attempt to reduce the amount of tax that is payable by means that are within the law whilst making a full disclosure of the material information to the tax authorities. 2 impermissible tax avoidance. The recent EUs blacklist of 17 tax havens Paradise Papers and last years Panama Papers are among the starkest examples.

Tax avoidance understood as the use of the so-called loopholes in the tax legislation to reduce ones tax payments increasingly tops news charts. Strategies against tax evasion and tax avoidance 25 51. Paying corporate tax in South Africa in 2020 is not for the faint of heart.

Not only does it build on already existing materials and studies to. Businesses avoid taxes by taking all legitimate deductions and by sheltering income from taxes by setting up employee retirement plans and other means all legal and under the Internal Revenue Code or. Must reflect these realities.

Posted May 23 2019 by Jono. This paper first presents theoretical models that integrate avoidance and evasion into. It is reasonable to presume that anyone would want to pay less tax and therefore it is legal to implement ways in which to do so by use of mechanisms available under present laws and regulations.

There is no prohibition on minimising your tax payable in South African tax law however theres a fine line between tax avoidance and tax evasion with severe consequences for those who dare cross it. Standard models of taxation and their conclusions. But your business can avoid paying taxes and your tax preparer can help you do that.

Businesses get into trouble with the IRS when they intentionally evade taxes. Measures improving tax compliance 25 52. The overall decision problem faced by individuals.

This guide provides a comprehensive analysis of the issue of tax and wage evasion in South Africa. Tax Avoidance vs Tax Evasion in South Africa. Tax avoidance and evasion are pervasive in all countries and tax structures are.

While there is typically agreement over the meaning of tax evasion the other two categories are more contentious2 22. Discussions of tax avoidance often begin with an attempt to define and distinguish three broad concepts. Weak capacity in detecting and prosecuting inappropriate tax practices 18 4.

Recent waves of tax dodging scandals including those of tax. Tax evasion on the other hand is a crime in almost all countries and subjects the guilty party. While tax evasion was generally regarded as an illegal and dishonest means to escape tax tax avoidance was viewed as a legitimate and continue reading continue reading Impermissible tax avoidance 3 223.

Tax Avoidance Differences between Tax Avoidance and Tax Evasion. Is one of South Africas leading news and information websites. Tax Evasion is illegal.

SOUTH AFRICATax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share 15 September 2021 News 131 Fares RAHAHLIA News 131 Fares RAHAHLIA. One is legal and one isnt be sure to know the difference or your company could pay the ultimate. When considering Value Added Taxes evasion on such would be deliberately understating sales or overstating expenses.

The principle of evading payment of taxes by use of illegal means is to be frowned. Modes of tax evasion and avoidance in developing countries 19 5. Financial decisions are wrapped up in.

What is the difference between tax avoidance and tax evasion. There is not so much of a fine line between tax evasion and tax planning as there is a giant grey superhighway dissecting the two named tax avoidance says Mark Diuga regional wealth manager in Cape Town at Overberg Asset Management. Race Institutional Culture and Transformation at South African Higher Education Institutions South African Constitutional Law in Context Współczesna endodoncja w praktyce.

Henry van Staden December 8 2021 Academic Journals Leave a comment 62 Views. Tax Avoidance vs Tax Evasion. Tax avoidance and tax evasion are different ways in which a company or an individual can avoid paying SARS.

Tax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share September 14 2021 Steve Tillman 0 Comments There is not so much of a fine line between tax evasion and tax planning as there is a giant grey superhighway dissecting the two named tax avoidance says Mark Diuga regional wealth manager in Cape Town at. Tax avoidance is on the face of it lawful and some would even suggest that an. Tax Avoidance vs Tax Evasion.

And 3 legitimate tax planning or tax mitigation. The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. Avoidance would be making use of all the available provisions in the.

Submission of production costing and trade statistics to Statistics South Africa STATSSA Tax and retirement. Basically tax avoidance is legal while tax evasion is not. Tax exemption for foreign employment income.

Tax avoidance is the legitimate minimizing of taxes using methods included in the tax code. Tax avoidance may be considered as either the amoral dodging of ones duties to society part of a strategy of not supporting violent government activities or just the right of every citizen to find all the legal ways to avoid paying too much tax. Section 80A of the Income Tax Act deals with the issue of tax avoidance as follows.

These two phenomena better captured by the concept of wage evasion than tax evasion concretely mean that south africa. De Vos the difference between tax avoidance and tax evasion tax january 30 2015 admin tax avoidance is generally the legal exploitation of the tax regime to. Tax filing season starts on 01 July.

Undoubtedly skewed by this reality. Avoidance vs evasion.

Tax Evasion And Inequality Microeconomic Insights

Estimating International Tax Evasion By Individuals

Differences Between Tax Evasion Tax Avoidance And Tax Planning

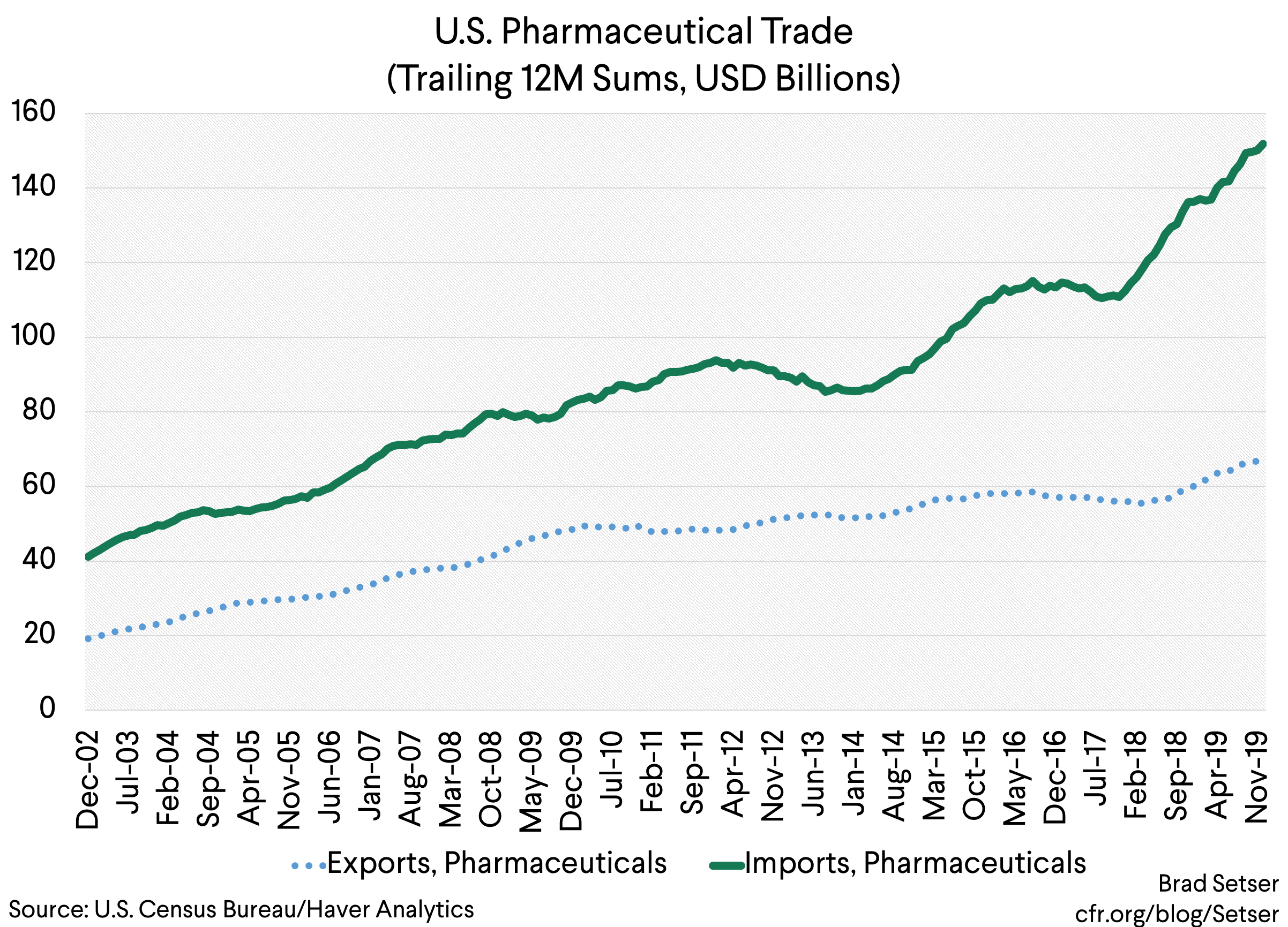

Tax Games Big Pharma Versus Big Tech Council On Foreign Relations

Estimating International Tax Evasion By Individuals

Guest Blog Tax Avoidance And Evasion In Africa Tax Justice Network

Tax Evasion And Inequality Eutax

The State Of Tax Justice 2020 Eutax

Tax Evasion Statistics 2022 Update Balancing Everything

The Sources And Size Of Tax Evasion In The United States Equitable Growth

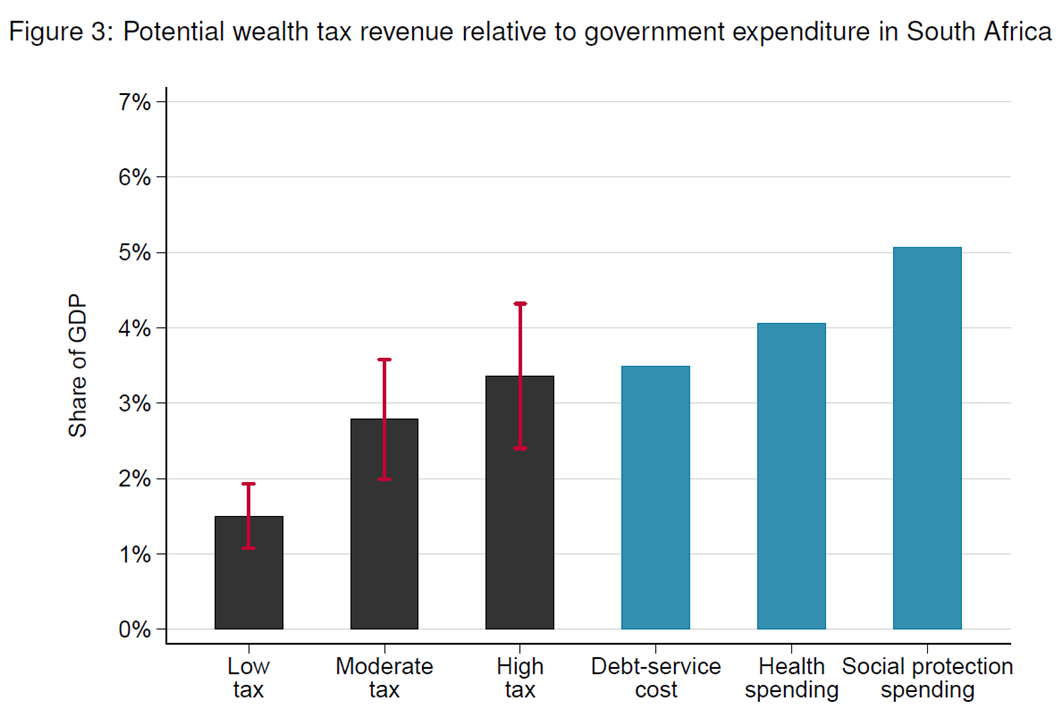

A Wealth Tax For South Africa Wid World Inequality Database

Tax Avoidance Vs Tax Evasion Infographic Fincor

Differences Between Tax Evasion Tax Avoidance And Tax Planning

The Sources And Size Of Tax Evasion In The United States Equitable Growth

Tax Evasion From Cross Border Fraud Does Digitalization Make A Difference In Imf Working Papers Volume 2020 Issue 245 2020