how to reduce taxable income for high earners 2020

Here are five tax saving tips that are easy to apply. High-income earners should consider donating low cost basis stock contributing to a donor advised fund or stacking future charitable donations in a single year to maximize tax deductions.

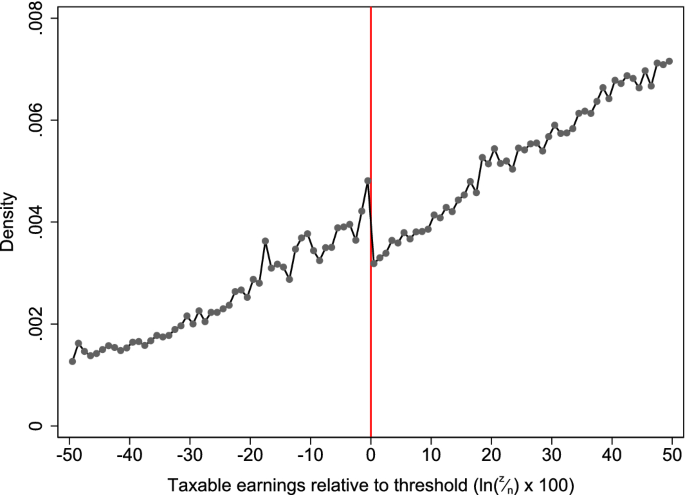

Frictions And Taxpayer Responses Evidence From Bunching At Personal Tax Thresholds Springerlink

For 201920 the annual pension contribution limit for tax relief purposes is 100 of your salary or 40000 whichever is lower.

. If youre a high-income earner wanting to reduce your taxable income start with these five strategies. Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post. Increase corporate taxes from 21 to 28.

Thats a tax saving between 9360 24 marginal rate and 14430 37 marginal rate. Reduce your taxable income in 2020. And if anyone is a beginner they can just have an online investing course.

Establish retirement accounts One of best ways for high earners to save on taxes is to establish and fund retirement accounts. On the other hand long-term capital gains tax rates are less than 20. Find a Dedicated Financial Advisor Now.

The second strategy real estate investing can help high income earners save on taxes is by using accelerated depreciation via a cost segregation study. Elimination of preferential capital gain rates for taxpayers with taxable income in excess of 1M. Invest in Qualified Opportunity Zones 6.

How to Reduce Taxable Income. If you are considered to be a high-income individual and have an adjusted income of more than 150000 per year and a threshold income of more than 110000 per year your annual allowance will be tapered. Monthly or annual savings goals for investments help develop financial discipline.

Elimination of like-kind exchange for gains exceeding 500000. Charitable donations are an excellent way for you to reduce your income tax liability. We provide you with information on converting to a Roth IRA You can buy municipal bonds.

A married couple can reduce taxable income by 39000. The income tax year is broadly 1 July to 30th June. Thus maxing out these contributions will lower your taxable income for that year.

There are many strategies to help you maximize your charitable contributions and reduce your income tax. Retirement Contributions One of the best ways that you can lower your taxable income is through pre-tax retirement contributions. This is where the IRS allows you to front load the depreciation instead of taking the standard 275 years.

A flexible spending account FSA provides a way to reduce taxable income by setting aside a portion of earnings in a separate account managed by an employer. Real Estate whose inheritance has been passed down. Hire Your Kids If Youre a Business Owner Final Thoughts.

Investing fundamentals will help high-income earners reach their financial objectives. For example in 2020 we plan to deduct all of the following from our taxable income. Its no secret that the new administration is planning to increase the top individual tax rate to 396 in addition to.

To reduce your reportable income you should start with maxing out your pre-tax 401k. How Can High Earners Reduce Taxable Income. Save money by opening a health savings account.

The maximum contribution for a 401 k in 2020 is 19500 and if you are over the age of 50 you are also eligible to contribute an extra 6000 a year in catch-up contributions. Make sure you have enough money to pay for your retirement. Most employers will give you the option of a pre-tax or a Roth 401k.

For 201920 the annual pension contribution limit for tax relief purposes is 100 of your salary or 40000 whichever is lower. Max your pre-tax 401k. Pension contributions for high earners 10 Tax Planning Strategies for High-income Earners.

Create your own fund to solicit funds from donors. Do Your Investments Align with Your Goals. An employee can contribute up to.

Max Out Your 401k The contribution limit for an individual in 2021 is 19500. 6 Tax Strategies for High Net Worth Individuals 1. The money you put into your retirement fund isnt taxable and therefore a great way to lower your tax bill.

High-income earners can reduce their tax burden by using investment vehicles. A Roth retirement account has its own benefits but it wont reduce your income this year. As the year draws to an end it also means the window for reducing your tax bill for the Year of Assessment 2022 YA 2022 is closing.

A maximum contribution of 2880 a year is topped up to 3600 thanks to tax relief. New Look At Your Financial Strategy. Income Splitting and Trusts 5.

Visit The Official Edward Jones Site. Long-Term Capital Gains You pay tax on short-term capital gains at your marginal income tax rate. Medicare Tax Loophole for High Earners.

How to reduce taxable income for high earners through your employer benefits. This is money earned when you sell investments less than a year after you purchase it. Qualified Charitable Distributions QCD 4.

As of 2020 you can place up to 19500 per year into your retirement account. You can deduct the amount you contribute to a tax-qualified retirement account from your income taxes except for Roth IR As and Roth 401 ks.

How Do Taxes Affect Income Inequality Tax Policy Center

What Tax Do I Pay On Savings And Dividend Income Low Incomes Tax Reform Group

Income Tax Task Cards Activity Financial Literacy Filing Taxes Math For Kids

How Do Taxes Affect Income Inequality Tax Policy Center

5 Smart Ways On How To Reduce Taxable Income For High Earners

Self Assessment Tax Returns For 100 000 Earners Goselfemployed Co

How Do Taxes Affect Income Inequality Tax Policy Center

10 Ways To Reduce Your Tax Bill Frazer James Financial Advisers

Statutory Marginal And Average Tax Rates As Percent Of Taxable Income Download Scientific Diagram

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

How Do Marginal Income Tax Rates Work And What If We Increased Them

Worried About Taxes Going Up 9 Ways To Reduce Tax

How To Reduce Taxable Income In 2021 Youtube

Lorenz Curve Of Pre Tax Income And Concentration Curve For Tax Download Scientific Diagram

How Do Taxes Affect Income Inequality Tax Policy Center

60 Tax Relief On Pension Contributions Royal London For Advisers

Tax And National Insurance Contribution Rates Low Incomes Tax Reform Group